Employees, Substitutes, and Coaches

*click black arrow to see drop-down menu items.

Employee Resources and Information

Payroll Forms

Request Forms

Tax Notification 2020

The 2020 Form W-4, Employee's Withholding Certificate, is very different from previous versions. This is due to the federal tax law changes that took place in 2018. The Internal Revenue Service (IRS) is not requiring all employees to complete the revised form and has designed the withholding tables so that they will work with both the new and prior year forms. However, certain employees will be required to use the new form: those hired in 2020 and anyone who makes withholding changes during 2020.

Even though the IRS does not require all employees to complete the revised form and even if your tax situation has not changed, we recommend you perform a "paycheck checkup" to see if you need to make adjustments to your current withholding. To conduct the checkup, you can use the IRS's Tax Withholding Estimator. Te effectively use the estimator, it is helpful to have a copy of your most recent pay stub and tax return. It is likely that the estimator will be updated to account for the 2020 tax tables in early January 2020.

Please note: if you do not submit a new form, withholding will continue based on your previously submitted form.

Before completing the 2020 Form W-4, please read the instructions that are included with the form. You must complete Steps 1 and 5. Steps 2,3, and 4 are optional, but completing them will help ensure that your federal income tax withholding will more accurately match your tax liability. Step 1 is for your personal information; Step 2 is for households with multiple jobs; Step 3 is used to claim tax credits for dependents; Step 4 is for other adjustments (additional income such as interest and dividends, itemized deductions that exceed the standard deduction, and extra tax you want withheld); and Step 5 is where you sign the form.

The IRS takes your privacy seriously and suggests that, if you are worried about reporting income from multiple jobs in Step 2 or other income in Step 4(a), you check the box in Step 2(c) or enter an additional withholding amount in Step 4(c). To determine the additional withholding amount, you can use the withholding estimator.

The IRS has also published Frequently Asked Questions that you may find helpful as you complete the form.

***Please note that since the Federal Form W-4 no longer utilizes withholding allowances, any employee that submits a new Form W-4 will also need to submit a State DE-4 form.

Substitute Resources and Information

California state law and/or district policy require that a number of forms be completed and verification provided by all Classified and Certificated employees and substitutes.

If you're interested in becoming a Classified or Certificated substitute with Exeter Unified School District, please complete the fillable substitute applications.

If you're interested in becoming a Classified or Certificated substitute with Exeter Unified School District, please complete the fillable substitute applications.

Please note: All forms will require a physical signature.

Application Submission

- Print (one-sided) and bring directly to the District Office during normal business hours.

- Email via PDF format to the specified Personnel Tehcnician:

- Classified applications: Raylene Veleta at [email protected]

- Certificated applications: Amber Garnett at [email protected]

Application Processing

Once all forms are received, you will be contacted to come to the District Office to sign and bring any further documentation necessary for the onboarding/clearance process.

For classified substitute, you will need to prove NCLB compliance. This can be accomplished by providing unofficial transcripts showing an A.A./A.S. degree, or 48 college units, or a passing score on the Tulare County Office of Education Instructional Aide exam. Instructional Aide Exams can be scheduled with Tulare County Office of Education.

For questions or more information regarding the substitute application process, please call our district office during regular business hours.

For questions or more information regarding the substitute application process, please call our district office during regular business hours.

Substitute Applications

Payroll Forms

Classified State Preschool Substitute Information

All personnel, including substitutes, licensee or employed staff of the State Preschool Program at Lincoln Elementary must provide additional proof of immunizations above and beyond those required to substitute at any Exeter Unified School District school site. These immunizations include:

- TB clearance

- Proof of Flu vaccination (or declination)

- Whooping Cough vaccination

- Measles vaccination

Vaccinations of this kind are not administered by Exeter Unified School District but are provided by Tulare County Health and Human Services using the information below.

Coaches Resources and Information

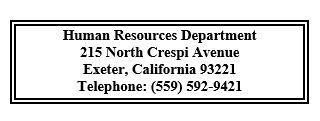

The following must be completed and submitted to the Human Resources Department to receive clearance. You will not be approved by the Governing Board to coach and cannot work with student athletes until all of the following criteria has been met and copies are on file.

-

- District Onboarding Packet completed and returned to the District Office.

- Current and Valid CPR/First Aide Cards* (ALL coaches).

- TB Clearance – Contact District Nurse for TB Questionnaire.

- Fingerprint Clearance (District will provide forms and send you to be fingerprinted electronically. Coach is responsible for rolling fee only. Cost is determined by location).

- Proof of completion of NFHS Fundamentals of Coaching Course* (Head Coach)

- Proof of completion of NFHS Concussion Course* (Annually)

- Proof of completion of NFHS Heat Illness Prevention* (Annually)

- Proof of completion of NFHS Sudden Cardiac Arrest* (Annually)

- Proof of completion of NFHS COVID19 for Coaches and Administration* (New)

- Proof of completion of Keenan Mandated Reporter Child Abuse and Neglect* (Annually)

- Proof of completion of Keenan Injury Illness Prevention Plan* (Annually)

*Training certificates of completion can be emailed to Amber Garnett at [email protected] via PDF format if you do not have access to a printer.

Any questions regarding the clearance process to become a coach with Exeter Unified School District can be directed to Amber Garnett at [email protected] or (559) 592-9421 ext. 0405.

Contact Information-

Personnel- Classified

Raylene Veleta

Personnel Technician

ext. 0408

Personnel- Certificated

Amber Garnett

Personnel Technician

ext. 0405

Payroll-Certificated

Jennifer Maurer

Budget Specialist

ext. 0418

Payroll- Classified

Equal Opportunity Employer/ Affirmative Action

Mandatory Training:

Employees/Substitutes/Athletic Coaches-

Athletic Coaches